Instructions to Pick the Right Senior Protection Plan.

Choosing the right senior protection plan is vital to guarantee monetary security during your retirement years. With a plenty of choices accessible, it very well may overpower. In this article, we will direct you through the most common way of picking the ideal senior protection intend to meet your particular necessities.

67+ Virtuoso Tricks of the trade You'll Wish You Knew Sooner

Survey Your Wellbeing and Clinical Necessities: Start by assessing your ongoing wellbeing status and expected clinical requirements later on.

Figure out Various Kinds of Senior Protection: Find out about the different sorts of senior protection, including Health care coverage, Medigap, and Health care coverage Benefit.

See Charges and Deductibles: Consider the expense of charges and deductibles related with various protection plans.

Audit Physician recommended Medication Inclusion: Assuming you require professionally prescribed drugs, guarantee that your protection plan covers them sufficiently.

Really take a look at Organization Suppliers: Affirm that your favored medical care suppliers are important for the arrangement's organization.

Assess Extra Advantages: Investigate any additional advantages like dental, vision, or hearing inclusion.

Consider Long haul Care Needs: Survey whether long haul care inclusion is vital in view of your family ancestry and wellbeing status.

Look for Proficient Direction: Talk with protection specialists or monetary consultants for customized direction.

Accumulate Data: Begin by social affair data on the different senior protection choices, including Medical coverage, Medigap, and Health care coverage Benefit.

Decide Qualification: Comprehend the qualification measures for every protection program to see which ones you meet all requirements for.

Investigate Expenses and Inclusion: See the expenses and inclusion given by every protection choice to figure out which great suits your spending plan and medical services needs.

Think about Future Requirements: Contemplate your future medical care needs and whether the protection plans you're thinking about will oblige them.

Survey Enlistment Periods: Know about enlistment periods for various protection plans and ensure you adon this page to them.

Talk with Specialists: Look for direction from protection experts or instructors who can give customized guidance.

Remain Informed: Keep awake to-date with changes in senior protection rules and projects to make changes depending on the situation.

Plan for Long haul Care: Think about long haul care requirements and whether you ought to buy extra inclusion.

All in all, choosing the right senior protection plan requires cautious thought of your monetary circumstance, wellbeing, and future objectives. By following the means illustrated in this article, you can pursue an educated choice that furnishes you with true serenity during your retirement.

67+ Virtuoso Tricks of the trade You'll Wish You Knew Sooner

Survey Your Wellbeing and Clinical Necessities: Start by assessing your ongoing wellbeing status and expected clinical requirements later on.

Figure out Various Kinds of Senior Protection: Find out about the different sorts of senior protection, including Health care coverage, Medigap, and Health care coverage Benefit.

See Charges and Deductibles: Consider the expense of charges and deductibles related with various protection plans.

Audit Physician recommended Medication Inclusion: Assuming you require professionally prescribed drugs, guarantee that your protection plan covers them sufficiently.

Really take a look at Organization Suppliers: Affirm that your favored medical care suppliers are important for the arrangement's organization.

Assess Extra Advantages: Investigate any additional advantages like dental, vision, or hearing inclusion.

Consider Long haul Care Needs: Survey whether long haul care inclusion is vital in view of your family ancestry and wellbeing status.

Look for Proficient Direction: Talk with protection specialists or monetary consultants for customized direction.

Accumulate Data: Begin by social affair data on the different senior protection choices, including Medical coverage, Medigap, and Health care coverage Benefit.

Decide Qualification: Comprehend the qualification measures for every protection program to see which ones you meet all requirements for.

Investigate Expenses and Inclusion: See the expenses and inclusion given by every protection choice to figure out which great suits your spending plan and medical services needs.

Think about Future Requirements: Contemplate your future medical care needs and whether the protection plans you're thinking about will oblige them.

Survey Enlistment Periods: Know about enlistment periods for various protection plans and ensure you adon this page to them.

Talk with Specialists: Look for direction from protection experts or instructors who can give customized guidance.

Remain Informed: Keep awake to-date with changes in senior protection rules and projects to make changes depending on the situation.

Plan for Long haul Care: Think about long haul care requirements and whether you ought to buy extra inclusion.

All in all, choosing the right senior protection plan requires cautious thought of your monetary circumstance, wellbeing, and future objectives. By following the means illustrated in this article, you can pursue an educated choice that furnishes you with true serenity during your retirement.

LATEST POSTS

- 1

Exploring the Difficulties of Co-Nurturing: Individual Bits of knowledge

Exploring the Difficulties of Co-Nurturing: Individual Bits of knowledge - 2

Well known SUVs With Low Energy Utilization In 2024

Well known SUVs With Low Energy Utilization In 2024 - 3

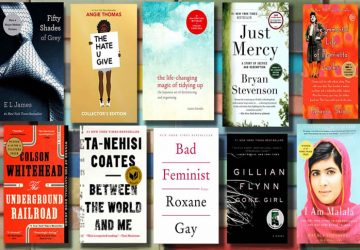

The Most Compelling Books of the 10 years

The Most Compelling Books of the 10 years - 4

Hundreds are quarantined in South Carolina as measles spreads in 2 US outbreaks

Hundreds are quarantined in South Carolina as measles spreads in 2 US outbreaks - 5

Figure out How to Explore Land Close to 5G Pinnacles

Figure out How to Explore Land Close to 5G Pinnacles

Share this article

Chemical leak in Oklahoma forces evacuations and leaves many ill

Chemical leak in Oklahoma forces evacuations and leaves many ill 'Peaky Blinders: The Immortal Man' teaser trailer reveals Cillian Murphy's Tommy Shelby back in action

'Peaky Blinders: The Immortal Man' teaser trailer reveals Cillian Murphy's Tommy Shelby back in action Merz postpones Norway trip for Belgium talks on frozen Russian assets

Merz postpones Norway trip for Belgium talks on frozen Russian assets Nikki Glaser returns as host of the 2026 Golden Globes: Everything the comedian has said about the upcoming awards show

Nikki Glaser returns as host of the 2026 Golden Globes: Everything the comedian has said about the upcoming awards show The Way to Monetary Freedom: A Viable Aide

The Way to Monetary Freedom: A Viable Aide Eco-Accommodating Kitchen Machines: 4 Picks for a Manageable Home

Eco-Accommodating Kitchen Machines: 4 Picks for a Manageable Home Pick Your Number one Sort Of Music

Pick Your Number one Sort Of Music The Way to Fruitful Weight reduction: Individual Wellbeing Excursions

The Way to Fruitful Weight reduction: Individual Wellbeing Excursions Overlooked infertility care should be part of national health services, says WHO

Overlooked infertility care should be part of national health services, says WHO